HDB 4 Room by Swiss Interior Design

HDB grants are payouts offered to Singaporeans to aid them in purchasing a new home. These payouts are also known as CPF housing grants.

The amount that you can receive from the grant will depend on numerous factors such as

- citizenship,

- employment status and

- household income.

In this article, we’ll cover the types of resale grants that you can apply for and the various criteria you’ll have to meet in order to be eligible for the grants.

- Enhanced CPF Housing Grant (EHG)

- Proximity Housing Grant (PHG)

- Singles Grant

- Family Grant (FG)

- Top-Up Grant

- Step-Up Grant

- Half-Housing Grant

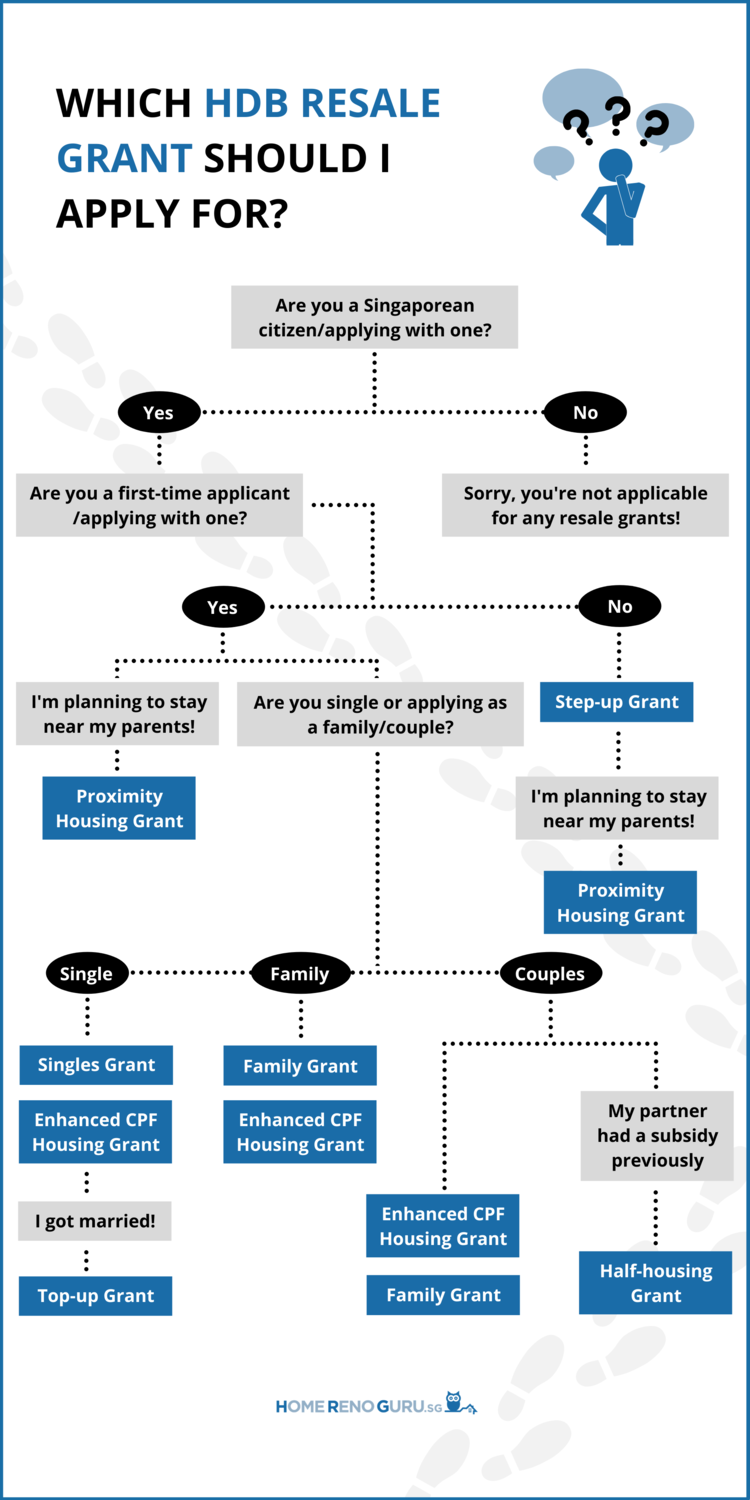

Which HDB Resale Grant Should You Apply For?

Deciding on the type of resale grant that you should apply for may be overwhelming at first.

Here’s a helpful flowchart you can use to help you make a more informed decision!

Read on for more information about the respective resale grants.

Types Of HDB Resale Grants

There are different types of resale grants for singles, first and second-timer applicants, couples/families and newly married individuals.

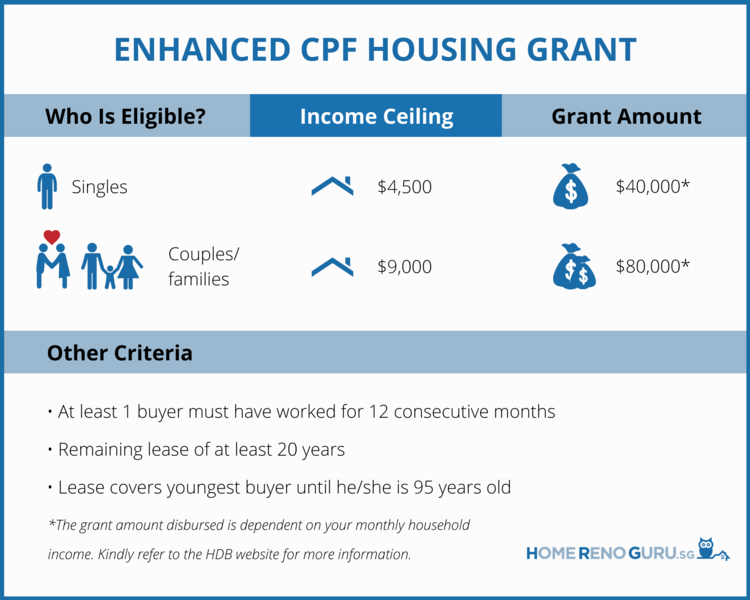

1. Enhanced CPF Housing Grant (EHG)

Who Is Eligible For The EHG?

Both singles and couples/families are eligible for the EHG.

Your average monthly household income must be

- Less than $4,500 (for singles)

- Less than $9,000 (for couples/families)

Additionally, at least one of the buyers must have worked for 12 consecutive months before applying for the flat.

Additional Criteria

In order to receive the full amount of the grant, the flat’s remaining lease must be a minimum of 20 years.

Additionally, it must be sufficient to cover you (for singles), your partner and the youngest buyer (for couples/families) until the age of 95.

If your flat is unable to meet these requirements, the grant amount you receive will be prorated.

How Much Can I Get From The EHG?

| Singles | Couples and Families |

|---|---|

| Maximum grant of $40,000 | Maximum grant of $80,000 |

The grant amount disbursed is dependent on your monthly household income.

You can refer to the HDB website for more information for singles and couples/families respectively.

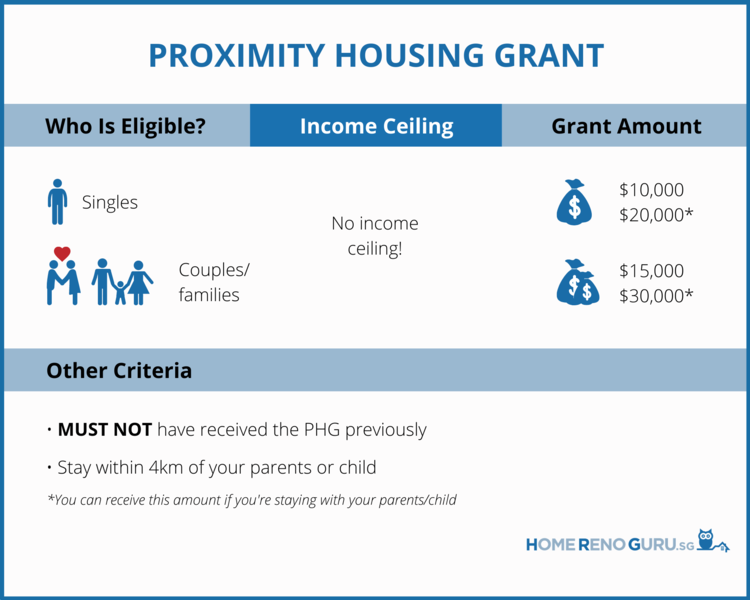

2. Proximity Housing Grant (PHG)

Who Is Eligible For The PHG?

The PHG encourages singles and couples/families to stay close to or with their parents.

While there are no restrictions on the applicant’s income ceiling,

- You must not have received the PHG grant previously

- Your resale flat must be within 4km of your parents’/child’s home

How Much Can I Get From The PHG?

| Singles | Couples/Families | |

|---|---|---|

| Staying within 4km of your parents/child | $10,000 | $20,000 |

| Staying in the same resale flat as your parents/child | $15,000 | $30,000 |

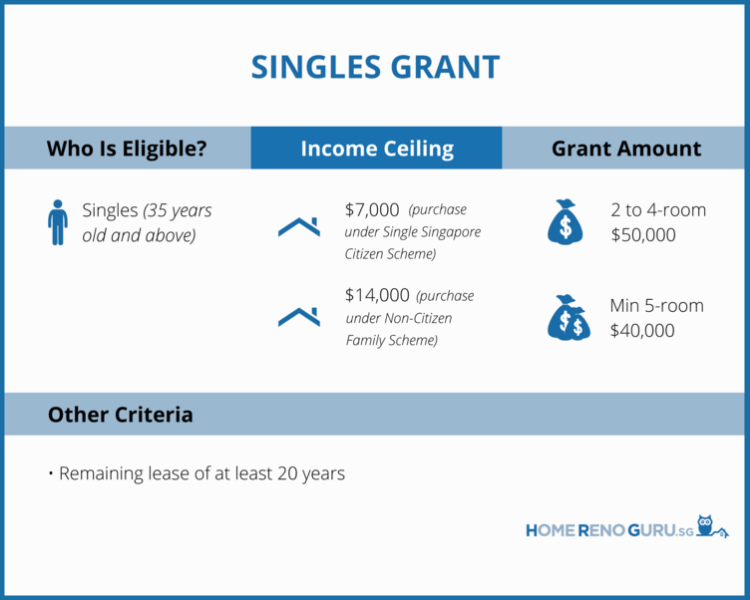

3. Singles Grant

Who Is Eligible For The Singles Grant?

You’re eligible for the Singles grant if you’re

- Single

- A first-time applicant

- 35 years old and above

You must also purchase a resale flat under either of these eligibility schemes:

Additionally, your average monthly household income must be:

- Less than $7,000 (if you’re purchasing under the Single Singapore Citizen Scheme)

- Less than $14,000 (if you’re purchasing under the Non-Citizen Family Scheme)

Additional Criteria

The Singles Grant requires that the flat has a remaining lease of at least 20 years.

How Much Can I Get From The Singles Grant?

| 2 to 4-room HDB resale apartment | 5-room HDB resale apartment |

|---|---|

| $25,000 | $20,000 |

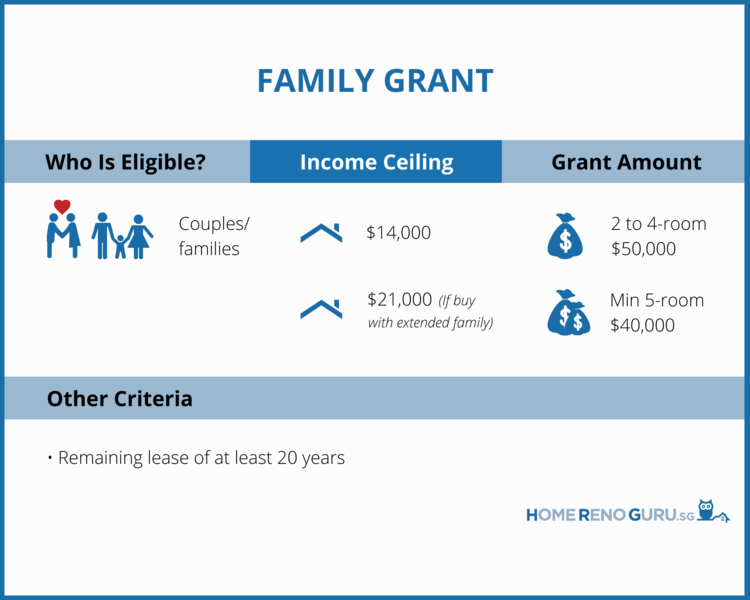

4. Family Grant (FG)

Who Is Eligible For The FG?

To be eligible for the FG, couples/families must be first-timer HDB resale flat with an average monthly household income of

- Less than $14,000

- Less than $21,000 (for those purchasing with extended family)

Additional Criteria

The FG requires the flat to have a remaining lease of at least 20 years.

How Much Can I Get From The FG?

| 2 to 4-room HDB resale apartment | 5-room or bigger HDB resale apartment |

|---|---|

| $50,000 | $40,000 |

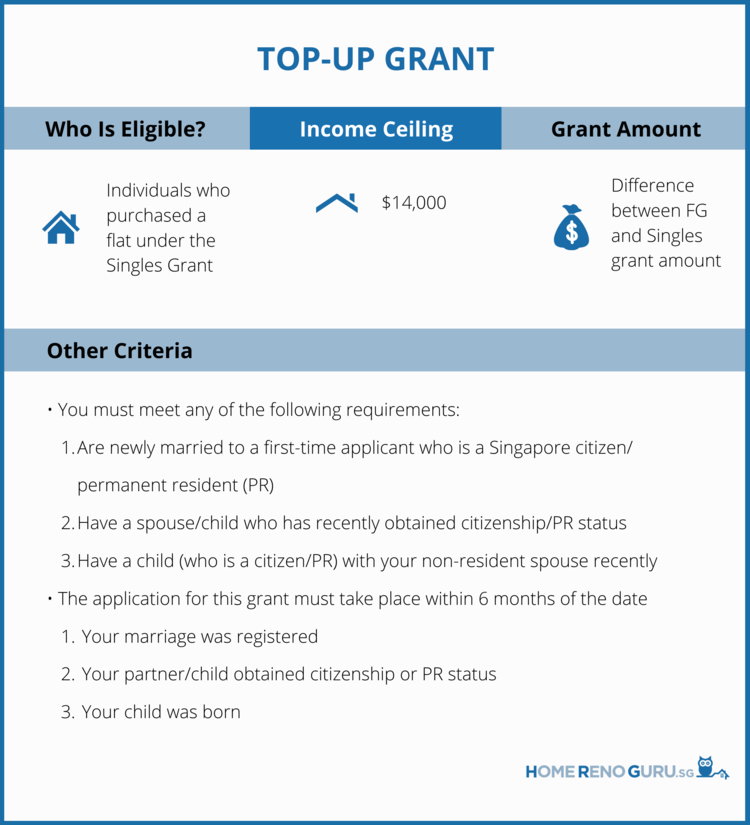

5. Top-Up Grant

Who Is Eligible For The Top-Up Grant?

If you’ve purchased a flat under the Singles Grant previously, you can apply for this grant if you:

- Are newly married to a first-time applicant who is a Singapore citizen/permanent resident (PR)

- Have a spouse/child who has recently obtained citizenship/PR status

- Have a child (who is a citizen/PR) with your non-resident spouse recently

The application must take place within 6 months of the date

- Your marriage was registered

- Your spouse/child obtained citizenship/PR status

- Your child was born

Additionally, your average monthly household income must not exceed $14,000.

How Much Can I Get From The Top-Up Grant?

The Top-Up Grant allows you to top-up to the full FG amount from your previous Singles Grant amount.

Hence, if you qualify for this grant, you will receive the difference between the two amounts.

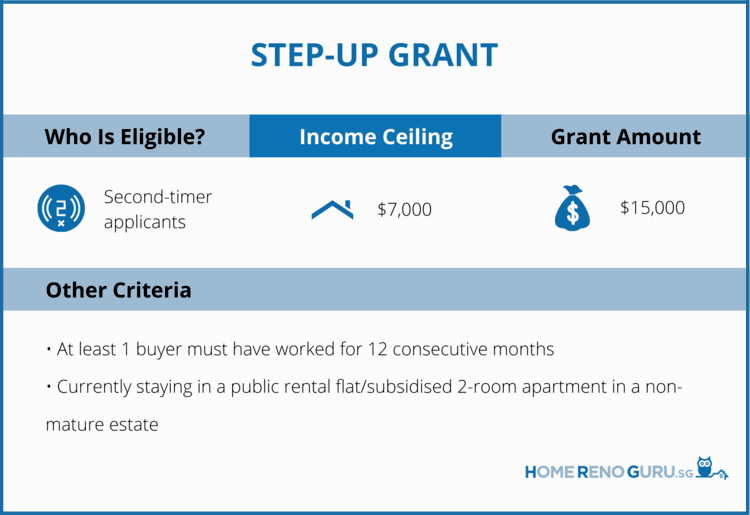

6. Step-Up Grant

Who Is Eligible For The Step-Up Grant?

This grant is for second-timer applicants who are applying for their second subsidised HDB apartment.

You should have an average monthly household income of no more than $7,000 and you/your partner must have been working for 12 consecutive months prior to the application.

Additional Criteria

In addition to the above, you must also be staying in a public rental flat or a subsidised 2-room apartment in a non-mature estate.

How Much Can I Get From The Step-Up Grant?

You can receive $15,000 under the Step-Up Grant.

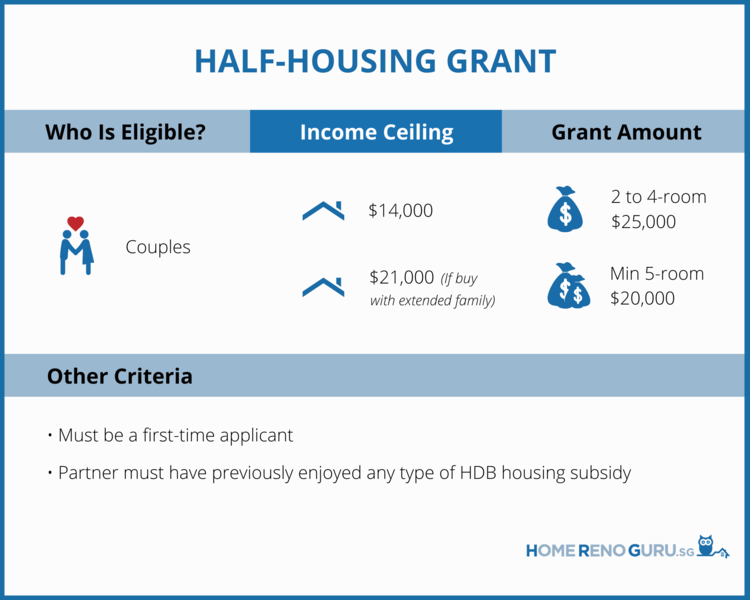

7. Half-Housing Grant

Who Is Eligible For The Half-Housing Grant?

You’re eligible for this grant if you are a first-time applicant and your partner has previously enjoyed any HDB housing subsidy.

Additionally, your average monthly household income must be:

- Less than $14,000

- Less than $21,000 (for those purchasing with extended family)

How Much Can I Get From The Half-Housing Grant?

| 2 to 4-room HDB resale apartment | 5-room or bigger HDB resale apartment |

|---|---|

| $25,000 | $20,000 |

Applying For Your Dream Resale Apartment

Thanks to the various grants available, buying a resale flat in Singapore is now more affordable.

Using these savings, you can now spend more on your home renovation and interior design projects!

Once you’ve figured out which grant you’re eligible for, find out how to apply for a HDB resale flat with this simple step-by-step guide!

FAQs

How will the HDB resale grants for couples be disbursed?

Instead of cash disbursements, all resale grant amounts will be credited to your CPF Ordinary Account.

For couples who are both citizens, the grant amount will be divided equally between the two accounts.

Do I have to pay back HDB grants?

Yes, you’ll need to refund the principal CPF amount used to purchase the flat as well as the accrued interest when you sell your HDB flat.

Can I use all my CPF savings to buy a HDB flat?

If the remaining lease of your flat has met the minimum requirement of 20 years, the amount that you can use from your CPF savings will be capped at the lower of the two:

- The value of the property or

- The price of the flat when it was purchased

Learn more about using your CPF savings to purchase a flat in this guide.

You can also use this handy CPF Housing Usage calculator to determine how much of your CPF savings you can use to purchase your flat.

How much cash do I need to buy a resale flat?

A maximum cash deposit of $5,000 is required when purchasing a resale flat.

This is calculated by adding the Option Fee (maximum $1,000) to the Option Exercise fee.

Can I still apply for the grants if one of the applicants has yet to graduate or complete their National Service?

Young couples who wish to apply for the grants can do so by deferring the income assessment until the date of key collection.

However, in order to be applicable for the income assessment deferral, you must fulfil certain requirements with regard to your

- Status as a student/NSF

- Age

- Marital status

- Household status